What?

The Pre-Certification helps financial instutitions to get ready for the Client Protection Certification by assessing compliance with the standards.

Why?

The Pre-Certification allows financial institutions to:

- Identify gaps in Client Protection principles implementation using the same tool and criteria as the Cerise+SPTF Client Protection Certification

- Address gaps by aligning internal systems and processes to the Certification norms

- Enhance the likelihood to obtain the Client Protection Certification

Who?

All financial institutions actively involved in promoting financial inclusion and keen on enhancing the implementation of client protection principles are invited to participate.

How it works?

The Pre-Certification assesses the financial institution’s policies, procedures, management systems, training, and marketing practices against the seven areas of client protection, using the same methodology as the Client Protection Certification.

It can be easily combined as part of a full certification process, offering costs efficiencies due to the synergies between the two exercises conducted within one year. Additionally, as an optional service, a certification follow-up is available upon the financial institution’s request. This option provides supplementary clarifications and monitors progress in addressing identified gaps.

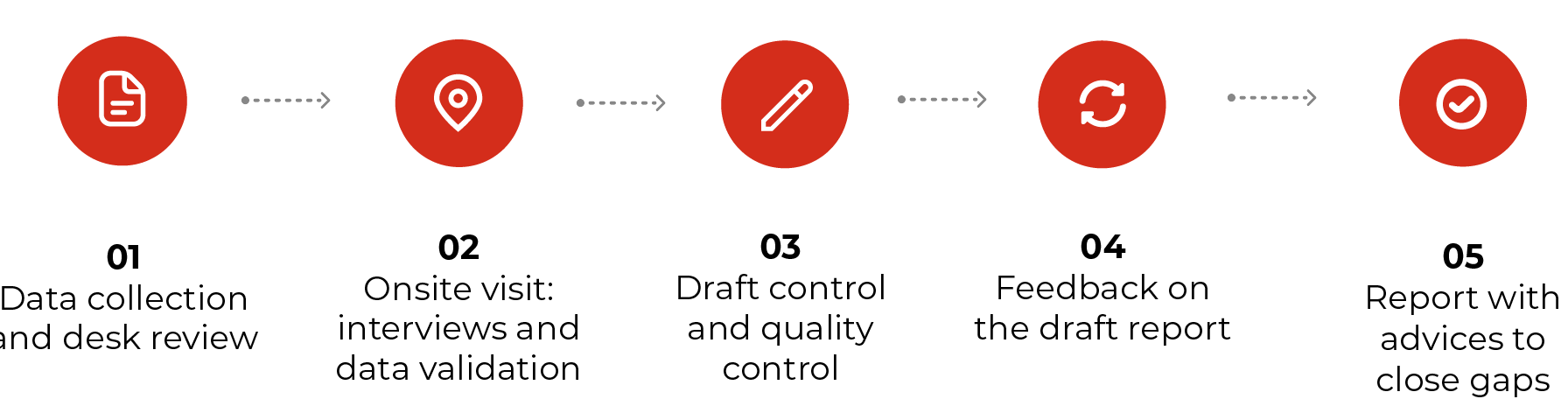

Process