What?

The Second Party Opinion (SPO) provides an expert assessment of a Green, Social, or Sustainability Bond Framework against the International Capital Market Association (ICMA) principles.

Why?

- Enhances the issuer’s credibility and increases the bond’s appeal by demonstrating alignment with ICMA principles to investors and other market stakeholders.

- Enhanced transparency facilitates the engagement between issuers and investors with shared impact goals.

- Analyses the strengths and opportunities for improvement in the Bond Framework, providing recommendations to the issuer on how to further strengthen its policies, systems, and tools.

Who?

Investors, mature financial institutions, development finance institutions, companies engaged in responsible finance, and banks that are not focused on microfinance or financial inclusion seeking to issue a Green, Social or Sustainability Bonds.

MFR’s experience with assessment of Social, Green and Sustainability investments

MFR has a strong record track record in assessing the Green and Social performance of organizations targeting low-income customers and Micro, Small and Medium Enterprises (MSMEs) in emerging markets. Through 400+ Social and Environmental Ratings, conducted in 50+ countries, MFR measures the capacity of an organization to achieve its social and environmental goals and to manage associated risks. The Social and Environmental Rating covers areas, similarly to the Second Party Opinion (SPO) on Green, Social and Sustainability Bond Frameworks, including:

- Review of the green and social objectives and intended benefits: Clear identification of SMART targets, including type of target population when applicable, to guide the lending or sale activity according to the intended green and social goals.

- Adequacy of criteria for project and product financing: Ensuring projects and products financed are align with intended green and social goals, meet green and social eligibility criteria (e.g. exclusion list), and rely on systems to manage green and social risks.

- Adequacy of reporting system: Evaluating the systems used to report on projects and products financed, the population reached, and the green and social objectives achieved.

- Governance and strategy alignment: Ensure that governance and strategic approaches align with green and social objectives.

How it works?

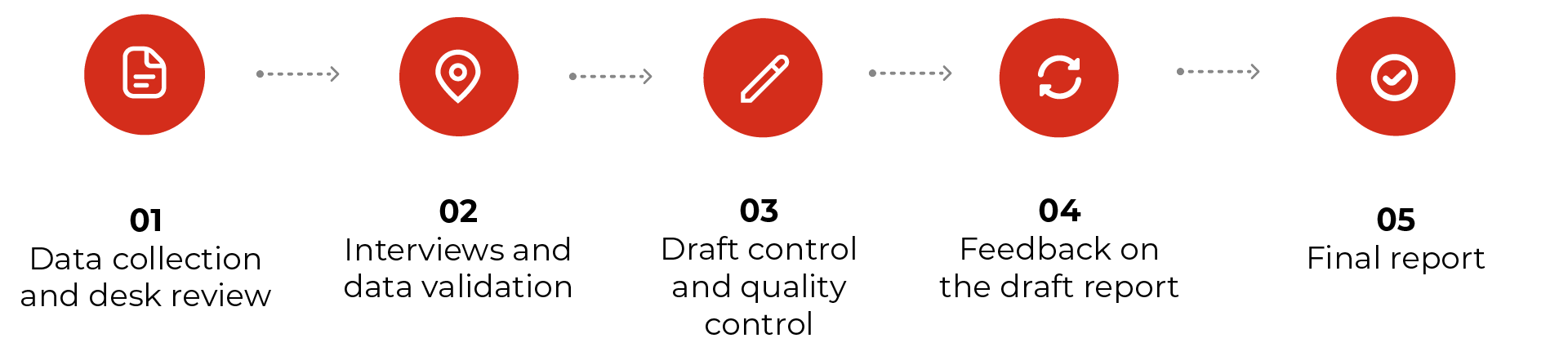

The SPO’s methodology is designed and tailored to the unique characteristics and needs of key players in inclusive and sustainable finance.

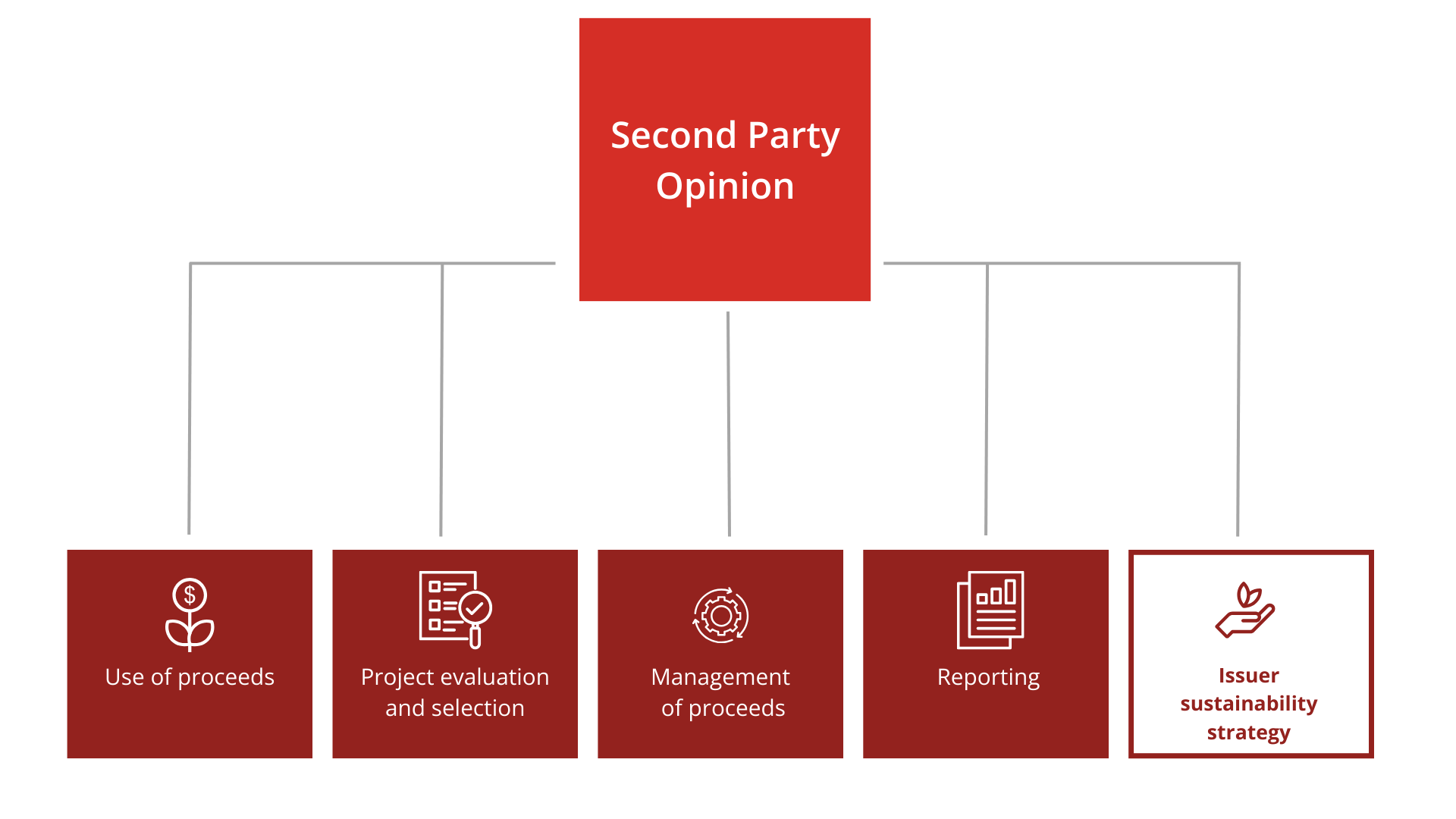

The assessment includes:

- Evaluation of the alignment of the Bond Framework with the four core components of the ICMA Principles:

- Assessment of the issuer’s overarching Sustainability Strategy alignment with the Bond Framework and rationale for Bond issuance.

- Mapping Use of Proceeds categories with the UN Sustainable Development Goals (SDGs).

- If applicable, evaluation of the alignment of the Bond Framework with ASEAN Standards.

- If applicable, analysis of the alignment of the Bond Framework with the EU Taxonomy.

Process

Assessed Organizations

| Company | Country | Date of the SPO Assessment | |

|---|---|---|---|

| Baobab | Senegal | April 2024 | |

| COAC Atuntaqui | Ecuador | January 2024 | |